In today’s volatile markets anyone can invest in platinum and hedging your future by holding a variety of asset types is a must. Platinum is an attractive asset for many investors due to its value, scarcity and the ease with which it can be traded. Find out how you can join them and increase your net worth by investing in platinum through a variety of ways, including equity, ETFs, futures and physical coin.

Why Invest in Platinum?

Platinum is an exceedingly rare precious metal. While nearly 82 million troy ounces of gold are mined each year, only 5 million troy ounces of platinum can be excavated during that same period. Like other precious metals, there is a finite quantity of platinum available. Because supply cannot increase, your investment in platinum will keep its value over time. Platinum does not go bad and can be easily broken up to be resold in chunks. These properties make platinum an ideal store of value and an excellent investment.

Why is Platinum a Good Investment?

Various international developments have increased investor concerns about the long-term stability of fiat currencies. Whether or not you subscribe to those beliefs, diversifying your assets across multiple asset classes in order to reduce risk is a sound strategy. By carefully timing your entry and exit from the platinum market, you can take advantage of other investors and leverage their speculation to help you buy low and sell high.

Platinum’s value as a rare and precious metal is fairly fixed in relation to other goods. Should rapid inflation occur, platinum will hold its value and keep your portfolio safe.

Is Platinum Investment Better than Gold?

While platinum jewelery is becoming more and more popular, a large amount of the demand for platinum is from the automobile industry. Platinum is a key component of autocatalysts, an engine component that helps to lower a car’s emissions and is required by law in many countries. This sort of static industrial demand is absent from gold and silver and helps to establish a high price floor for platinum. When investing in platinum, your investment goes up in value as automobile production increases. This makes platinum an ideal investment in any sort of economy.

Platinum’s supply is very limited. Most platinum comes from a small number of mines in South Africa. The production from these mines is often interrupted by regional violence, union disputes or political problems. Because of this, platinum is prone to huge price spikes. If you invest in platinum, you can take advantage of these spikes to double your money — or more — in a relatively short time frame. Best of all, even if you miss the spikes or plan on investing more long-term, steady industrial demand makes platinum a safe investment over longer periods.

It is important to consider these price spikes when timing your entry into the platinum market. While you do not need to stay abreast of current developments as a long-term investor, it is necessary to know if a spike is occurring while you enter the market. If headlines show that turmoil in South Africa’s mining community is driving prices up, consider shorting platinum or delaying your investment until prices are more stable. If you wish, you can watch for future spikes and sell off part or all of your investment for a profit, or you can simply go long to hedge some of your other investment options.

Platinum Investment Options

While the safest way to hold platinum is to buy physical bars, this process is complicated, expensive and requires you to physically deliver to a buyer when it’s time to liquidate. Luckily, alternatives exist. Futures contracts remain a popular option for investors for investing in platinum without actually dealing with physical bars. ETFs and equity options allow even easier entry to the market.

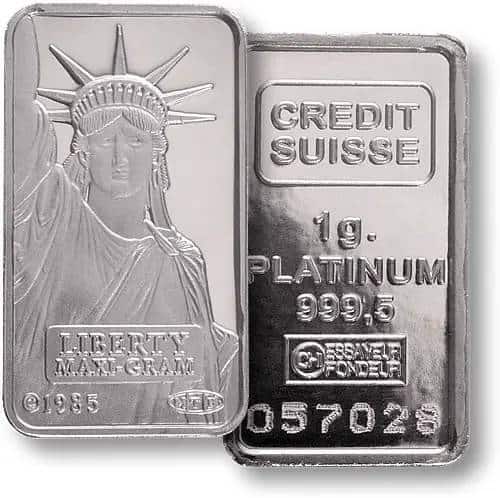

Physical Platinum

Both platinum coins and bars have a very high value to density ratio. This makes it cheap to store and move compared to other assets. Investors can buy bullion or coins from reputable dealers and hang on to it until it’s time to sell. Physical platinum is not without its share of complications: investors must make sure bars meet various quality standards, and there may be a premium for buying coins or bullion. Physical platinum can be difficult to sell on short notice in some locales; be sure to research your local market before you buy.

Futures

Platinum futures are an option for investing in platinum without buying physical bars. Futures contracts are easy to trade on various commodity markets. While it’s possible to buy physical platinum with futures, most investors prefer the liquidity of futures contracts and choose to sell their contracts before they settle. Futures are tied more directly to the price of platinum than equity.

ETF

ETFs, or exchange-traded-funds, are securities traded on various markets that are tied to the value of platinum. Because transactions are handled through the stock market, purchasing ETFs is even easier than purchasing futures. While platinum ETFs are not as common as gold or silver ETFs, there are ETFs available to cover every region. Best of all, short ETFs make taking either market position simple.

While ETFs are very similar to platinum futures, bear in mind that they are not directly tied to physical platinum. Extreme pricing events may test the validity of ETFs and you may not be able to redeem them for the value you want. This should not be an issue for normal investing. If you are holding platinum as a hedge against a currency collapse or some other catastrophic event, however, you may wish to purchase physical platinum or futures instead.

Equity

Rather than investing directly in platinum, many investors choose to purchase stock in mining companies and platinum distributors. While these stocks are tied to the performance of the company, they still have a strong correlation with platinum trends and spot prices. Like ETFs, platinum equity is extremely easy to add to your portfolio.

Bear in mind that the value of your equity is tied to the performance of an individual corporation. This means that your equity can fluctuate in value independent of the platinum market. Be sure to research all available options and choose a company that meets the needs of your portfolio when you are ready to invest in platinum.

Raahe Guide Raahen Esittely

Raahe Guide Raahen Esittely